This article provides information on insurance program development in Appulate.

Overview

MGAs and carriers can use Appulate to put their insurance programs online. This provides a staging area for the electronic submission data collection and subsequent risk underwriting and quote generation for both retail agents and internal underwriters.

The purpose of this article is to describe the main components that comprise the Appulate Insurance Program and to provide the roadmap for MGAs or Carriers to follow to gather the requirements needed by the Appulate’s engineering team. MGAs and carriers' benefits:

- Receiving completed submission: no need to go back and forth with the agent to collect data and documents.

- Faster turnaround time on quotes: agents are encouraged to do more business with you.

Appulate's Insurance program consists of the following components:

- Insured tab questionnaire

- ACORD and supplemental forms

- Miscellaneous documents and loss runs

- Rating

- Quote generation

- Request-to-bind procedure.

Let us review each of these components individually.

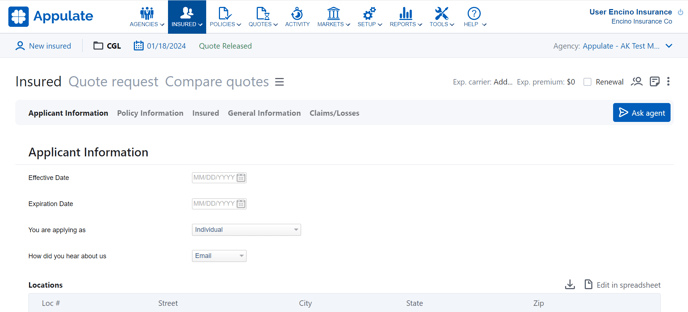

Insured tab questionnaire

Apart from the Insured tab questionnaire, which contains general information about the insured, Appulate has the Market Smart Q&A feature, which are market-specific questionnaires.

Appulate’s Insured tab questionnaire is the main vehicle for data collection about the insured. It is “smart” because the questions that Appulate presents to the user are context-driven and can change based on the information already collected.

There are three main dimensions that initially define the questionnaire:

- Insured Business Type (e.g. Farms, Hotel, Restaurant, Contractors - Landscaping, etc.)

- Insurance Line (work comp, general liability, commercial auto, etc.)

- Market, which in Appulate terminology is a common term used for MGAs and carriers.

The questionnaire can also subsequently grow or shrink based on the information already provided. The simplest illustration of this would be, for example, after the question “Is the insured engaged in any other type of business? there would be “If Yes, explain” question that would naturally appear only if the main question was answered Yes. But, there could also be a much more elaborate logic used to ask or not to ask the whole series of questions that would take into account many factors about the insured, like business location, estimated premium, loss history, insured proximity to hazardous zones, to give just a few examples.

The whole idea behind our Insured tab questionnaire is to present the user with a fast and convenient interview process to collect the required information about the insured without the burden of asking too many and especially not relevant questions.

So, for example, if designed correctly, Appulate wouldn’t be asking about the number of beds if the insured is a gas station. It would only ask such a question if the insured is a hospital.

Aside from being dynamic as described above, questions in Appulate can be designated to be required/non-required, as well as have data validation rules and data lookups associated with them.

Here are some use-case examples of Appulate’s questionnaire in action:

- Depending on when the business started, require up to five years of insurance history. If this is a new business, require none.

- Completely different sets of underwriting questions for different types of business (e.g. restaurants and farms).

- For the Class code 55832 and if “Metal work performed?” is answered Yes, then the additional question “Please describe” will appear and will be required, and also additional “Any metal forging operations?” must be answered.

- If the insured status is “Married”, ask an additional question about the spouse.

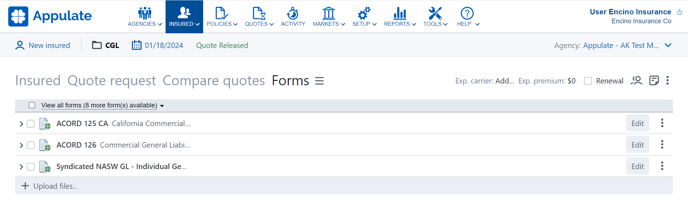

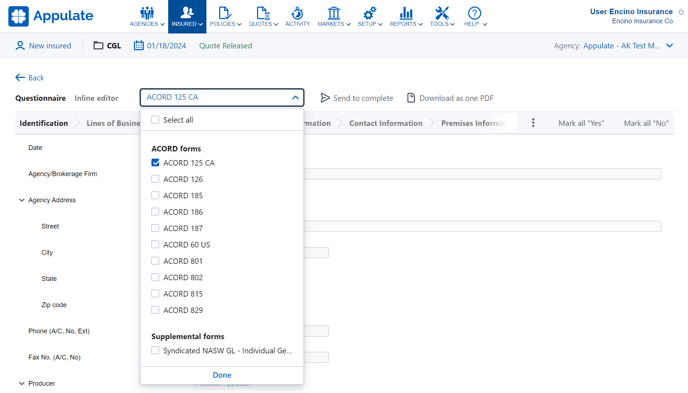

ACORD and supplemental forms

Appulate can produce all the relevant ACORD and supplemental forms as part of the submission process. These forms can be found on the Forms page. In addition to that, Appulate provides UI to complete these forms online individually as well (Questionnaire and Inline editor).

All these forms can be electronically signed. As such, they could be made part of the submission process workflow or, for example, be a required step when the quote is requested to be bound. The forms can be signed by the producer or the insured.

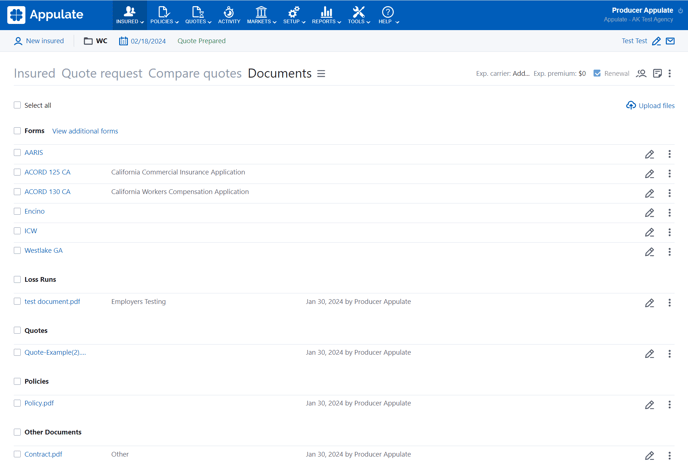

Miscellaneous documents

Optionally, Appulate can also accommodate rules and requirements for various miscellaneous documents as well as loss runs, as a part of the submission process. For example, if the insured does not have coverage this year, you may want to require them to attach a “Notice of Cancelation” as part of the submission.

Loss runs are organized on their page.

Other documents would be stored on the Documents page.

Rating

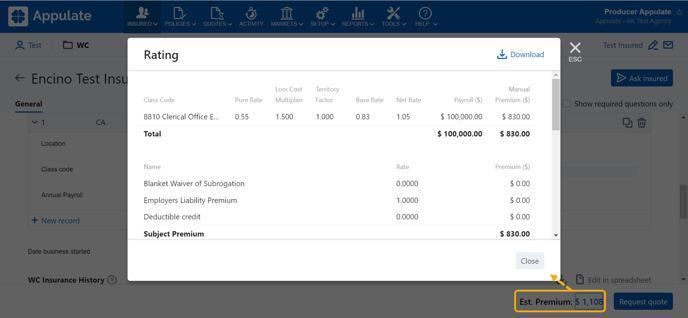

Appulate has a rating engine that can be used to calculate the premium. Each rating algorithm must be unique; thus some custom development would always be required to implement it. Appulate can also call out to an external rating engine provided via web-services API.

Appulate has a place on the interface to display an estimated premium, as well as the same rating calculation, which would be used to produce the quote.

Quote generation

After the questionnaire is completed, and all the required data artifacts have been provided, Appulate can now generate a quote (only if the market supports quote generation).

- If the submission was qualified as admissible, the retail agent will be able to get the quote by themselves.

- If the submission was referred to underwriting, the underwriter on the MGA or carrier side will be notified about the submission, and they will decide whether to issue the quote or not based on their subjective assessment of the risk.

But in both cases, Appulate could be used to facilitate the actual quote creation. So the MGA or carrier that wants to take advantage of this will need to provide Appulate with the quote template.

Request to bind

Appulate can also be used to define which specific steps an agent user would need to go through to initiate the policy binding workflow within Appulate following the acceptance of the quote by the insured.

These additional steps may include the following things:

- Asking for additional questions.

- Signing various ACORD and supplemental insurance forms, by the producer, the insured, or both.

- Uploading additional documents.

So the MGA or carrier will need to provide a description of what they want to see to be implemented as part of this step of their program implementation on Appulate.

How to start outlining for implementation

- Chose a line of business to start.

- Pull a PDF of all of the ACORDs.

- Highlight all questions that should be asked in one color.

- Highlight all questions that should be required in another color.

- In a separate document (e.g. Microsoft Word or Excel) add comments or notes and additional rules and requests.

- Review and confirm with your team, then turn in to your implementation lead to review and add to the queue. An ETA will be returned to you in a few days.

- Chose the next line of business and follow 2-6 above.

- Once your LOB has been implemented, log into a test agency account and test. Document any concerns, changes in a Microsoft Word document using images. Turn them into your implementation lead.

There is also a fine line between having as many requirements as possible to completely eliminate the back and forth process of gathering information for the quote and asking too many questions that it takes the agent a tremendous amount of time to work through it. Taking full advantage of the component that makes this a smart and dynamic questionnaire will help balance this.